TAKE CONTROL OF YOUR FINANCES WITH POWERFUL ACCOUNTING SOFTWARE FOR BUSY BUSINESSES

Spending hours on manual data entry and outdated spreadsheets? Our cloud-based accounting software makes managing your finances a breeze. Automate tasks, gain real-time insights and focus on what matters most - growing your business.

Accounting Software for Business Owners and Accountants

Account-Care is online accounting software that manages your finances and business workflows. Easy-to-Use accounting and bookkeeping.

-

Automated Reports

Automatically create Day Book, Cash Book, Bank Book, Receipt & Payment Statement, General Ledger, Trial Balance, Profit & Loss Account, Balance Sheet etc. and all accounting and financial reports with a single stroke of creating a voucher whenever a financial transactions take place across the organization or stakeholders.

-

Easy User Journey Flow

A very simple and easy users journey flow is the hallmark of Account-Care, one hardly feels the journey as he moves through the system without needing any help or assistance and finishes with a great deal of accounting tasks already accomplished by the time he gets off the screen.

-

Accountant

Accountant professionals experience an extremely easy, accurate and time saving experience with Account-Care software. that makes their lives easy and comfortable as an error free accounting is what the management expects from them....

-

Customization

Our software can be customized to suit the unique requirements of each and every organization of different product and service orientations.

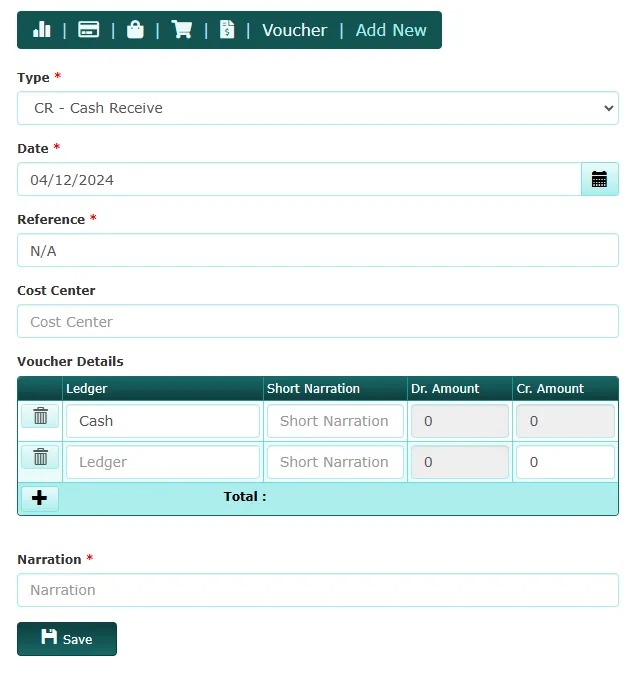

Voucher Entry Simplified

Effortlessly manage your financial transactions with Account-Care’s Voucher Entry module. Whether it’s cash payments, bank transactions, or journal adjustments, our intuitive interface streamlines the entire process. Record, edit, and verify entries in real-time while maintaining complete transparency with audit trails.

-

CR - Cash Receive

Accurately record cash inflows to maintain transparent financial statements, ensuring proper tracking of revenue and receipts.

-

CP - Cash Payment

Efficiently manage and document all cash disbursements, ensuring accurate expense tracking, budget control, and a transparent audit trail.

-

BR - Bank Receive

Log funds deposited into bank accounts with precision, supporting reconciliation and accurate bank balances in financial records.

-

BP - Bank Payment

Manage bank payments systematically to ensure streamlined financial transactions and easy reconciliation with bank statements.

-

JV - Journal Voucher

Record all non-monetary transactions and adjustments with precision, ensuring comprehensive financial reporting and compliance.

-

CV - Contra Voucher

Handle internal fund transfers between cash and bank accounts seamlessly, supporting proper cash flow management and ledger accuracy.

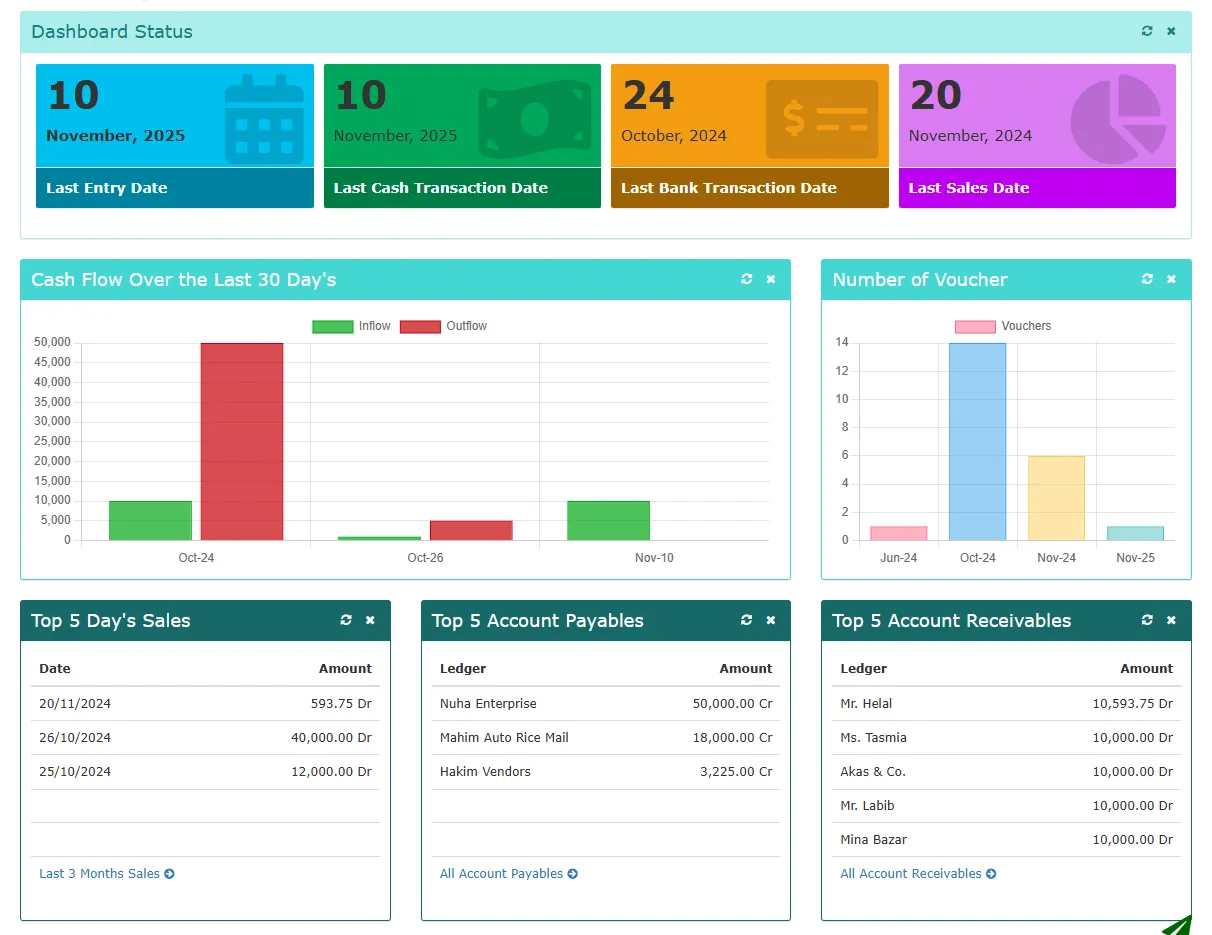

Comprehensive Financial Reports

Empower your business with insightful and accurate reporting:

Day Book

Get a daily snapshot of all financial transactions in one place.

Cash Book

Maintain detailed records of all cash transactions for better cash flow management.

Bank Book

Track all bank-related transactions and reconcile with ease.

Cash Flow Statement

Visualize your business’s cash inflow and outflow for better liquidity planning.

Receipt & Payment Statement

Generate clear summaries of all receipts and payments over any period.

General Ledger

Access detailed transaction history for any account at your fingertips.

Budget Compare Statement

Measure your financial performance against planned budgets to ensure goals are met.

Credit Limit Statement

Monitor customer credit limits and stay informed about overdue balances.

Fixed Assets Schedule

Keep track of your fixed assets with depreciation schedules and maintenance logs.

Trial Balance

Validate the accuracy of your accounts with real-time trial balance with perpetual reports.

Profit & Loss Account

Evaluate your business’s profitability with detailed income and expense reports.

Balance Sheet

Gain a clear overview of your financial position with up-to-date balance sheets.

| Demo Company | |

| Balance Sheet | |

| As on Date : 15/07/2018 | |

| Particulars | Amount |

|---|---|

| Assets | |

| Current Assets | |

| Account Receivables | 90,268.00 |

| Stock-in-Hand | 9,28,126.00 |

| Cash-at-Bank | 53,87,900.00 |

| Cash-in-Hand | 13,75,259.00 |

| Other Receivables | 1,00,000.00 |

| Sub Total : | 78,81,553.00 |

| Non Current Assets | |

| Fixtures and Fittings | 3,00,500.00 |

| Office Equipment | 1,71,500.00 |

| Sub Total : | 4,72,000.00 |

| Summary for Assets : | 83,53,553.00 |

| Liabilities | |

| Current Liabilities | |

| Account Payables | 12,72,652.00 |

| VAT Payable | 4,748.50 |

| Sub Total : | 12,77,400.50 |

| Non Current Liabilities | |

| Payables Non Current | 9,000.00 |

| Equity | |

| Opening Profit & Loss Account | 0.00 |

| Profit & Loss Account | 5,01,947.50 |

| Capital Account | 65,65,205.00 |

| Sub Total : | 70,67,152.50 |

| Summary for Liabilities : | 83,53,553.00 |

Master Information Management

Organize your financial data for efficient bookkeeping and analysis:

Chart of Account [Group]

Organize your financial framework with a structured and customizable Chart of Accounts. This feature allows businesses to define categories for assets, liabilities, income, expenses, and equity, ensuring detailed and accurate financial reporting.

Basic Ledger & Ledger

Gain control over your financial records with efficient ledger management. Record, update, and maintain detailed financial transactions for each account, ensuring comprehensive tracking. This feature supports reconciliation, error-free bookkeeping, and detailed reporting for informed decision-making.

Cost Center

Optimize financial oversight by monitoring expenses and revenues across departments, projects, or business units. Cost centers help in allocating resources effectively, tracking profitability, and ensuring accountability for financial performance.

Fixed Assets

Simplify asset management with tools to track the lifecycle of fixed assets. From acquisition to depreciation and disposal, this feature ensures compliance, accurate valuation, and effortless reporting, helping you maintain control over your business's physical and intangible assets.

Budget

Empower your financial strategy with robust budget planning. Define budgets for different departments or projects and monitor them in real time. Identify variances, control costs, and ensure profitability through effective budget management.

Opening Balance

Smoothly transition between financial periods by setting up accurate opening balances. This ensures continuity in bookkeeping and provides a clear starting point for financial tracking, helping maintain consistency and reliability in your accounts.

Why Choose Account-Care?

Experience efficiency, scalability, and security in one platform. Account-Care isn’t just accounting software—it’s your partner in success.

Ease of Use

Account-Care is designed with simplicity at its core, featuring an intuitive interface that makes it accessible to users of all experience levels. Navigate effortlessly through complex workflows and focus on what matters most—growing your business.

Customizable

Whether you’re a startup, SME, or large enterprise, Account-Care adapts seamlessly to your business size and industry requirements. Create custom reports, workflows, and configurations to suit your unique processes.

Powerful Reporting

Unlock the power of your financial data with robust reporting tools:

- Trial Balance, Profit & Loss, and Balance Sheet: Get a clear snapshot of your financial health at any time.

- Day Book, Cash Book, and Bank Book: Maintain complete transparency of transactions, both big and small.

- Cost Center Analysis: Evaluate performance across departments with in-depth analysis.

Efficient Workflow Automation

Streamline tasks with features like automated depreciation schedules, opening balance adjustments, and error-proof data entries. Account-Care optimizes your workflow to save time and eliminate manual errors.

Scalable and Future-Ready

As your business grows, Account-Care scales with you. Add new modules, users, and features without interruptions, ensuring your accounting platform evolves with your needs.

Secure by Design

Your financial data is your most valuable asset, and Account-Care prioritizes its safety with:

- Data Encryption: Protect your information from unauthorized access.

- Regular Backups: Ensure data continuity even in unforeseen circumstances.

- Audit Trails: Maintain compliance and accountability with detailed activity logs.

Export and Share with Ease

Export reports to Excel, Word, or PDF formats effortlessly for presentations or audits. Impress stakeholders with professional, polished documentation at the click of a button.

Experience efficiency, scalability, and security in one platform. Account-Care isn’t just accounting software—it’s your partner in success.

Advanced Features

Account-Care enables you access accounting information of your business anywhere, anytime. This helps you remain always up-to-date about the financial health of your business.

- All History in Audit Trails

- Easy verification of data input

- Shows result for a period defined

- Any correction of a single command

- Multiple users can work at a time

- Automatic data backup

- Export to EXCEL, WORD & PDF

- Change digit group of numerical figure

- Customize according to your needs

- Various reports with balance-sheet

Frequently Asked Questions (FAQ)

Get answers to common questions about our accounting software. Learn about its features, customization options, security measures, and how it can simplify your financial management. Explore solutions tailored to small businesses, startups, and enterprises.